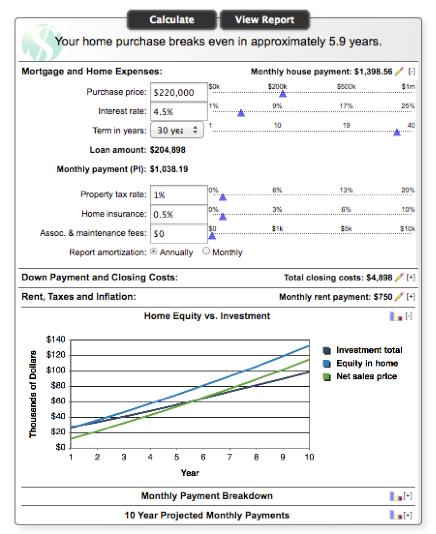

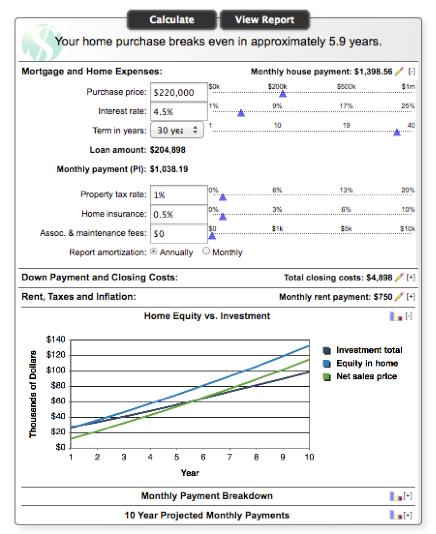

When determining if you should rent or buy – you’ll need to look at all the expenses associated with homeownership. Once you have the dollars and cents, you can calculate how many years it will take for you to break-even on buying versus renting.

If you only plan on staying in a home for a few years, it might not be a good investment – but if you plan on staying for five or more – it could be a good move.

The best way to determine your situation is to use a calculator like this one and start playing with difference scenarios.

If you only plan on staying in a home for a few years, it might not be a good investment – but if you plan on staying for five or more – it could be a good move.

The best way to determine your situation is to use a calculator like this one and start playing with difference scenarios.

Here’s what you’ll need:

- An estimated home purchase price

- Current interest rates

- The number of years you want to finance your loan

- Calculate annual property tax

- Home insurance

- Association and maintenance fees estimate

- Select whether you want the report to calculate a monthly or annual estimate

- Down payment and closing costs estimate

- Your monthly rent payment

How to calculate:

- Visit our Rent vs. Buy Calculator

- Plug in your numbers

- Click “Calculate”

- You will receive results for:

- The number of years it will take to “break even” on your home purchase

- Home equity vs. Investment graph

- Monthly payment break-down

- 10-year projected monthly payments graph

As you start looking into the possibility of buying a home, you can always use our team has a resource – feel free to give us a call and we would be happy to walk you through each scenario: 800-531-3837.

.png?sfvrsn=36a6b5b3_0)

User Not Found

User Not Found